In 2015, a

slowdown in Chinese economic growth, serious overcapacity, low prices,

increasing burden from environmental protection and product homogenization

hinder the development of amino acid enterprises. They struggle for development

and make sweeping transformation and reform, in order to remain competitive and

profitable in the overall industry, according to CCM.

In 2015,

China's GDP growth was 6.9%, which didn't reach the 7% growth target. Economic

growth is slowing down. Domestic amino acid industry experienced a difficult

year under such backdrop.

Key points

throughout the whole year of 2015

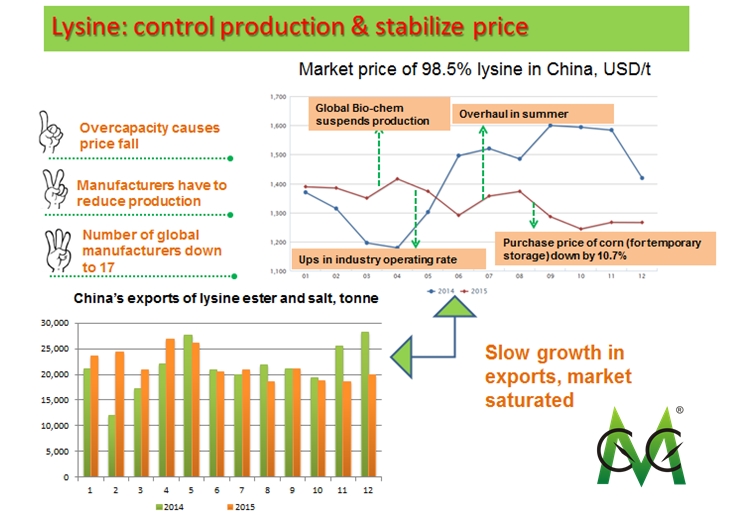

Excessive

expansion

Feed grade

amino acid is the main force in domestic market. Because of excessive

production expansion before, lysine manufacturers were forced to control

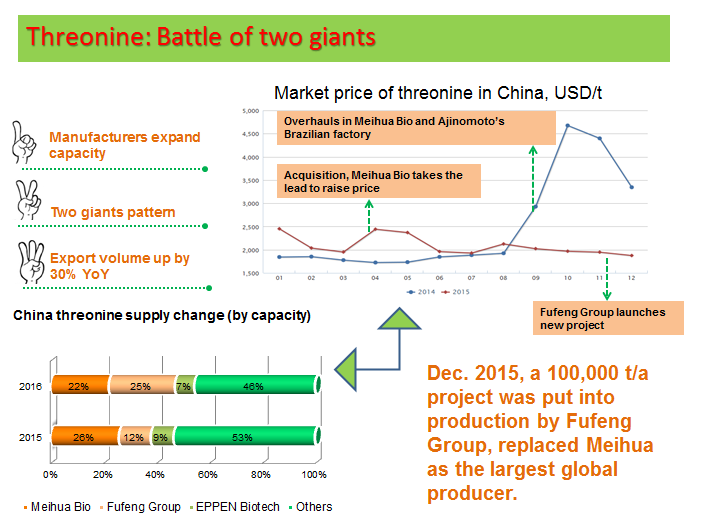

production to against the continual fall in price; threonine has entered the

market saturation period.

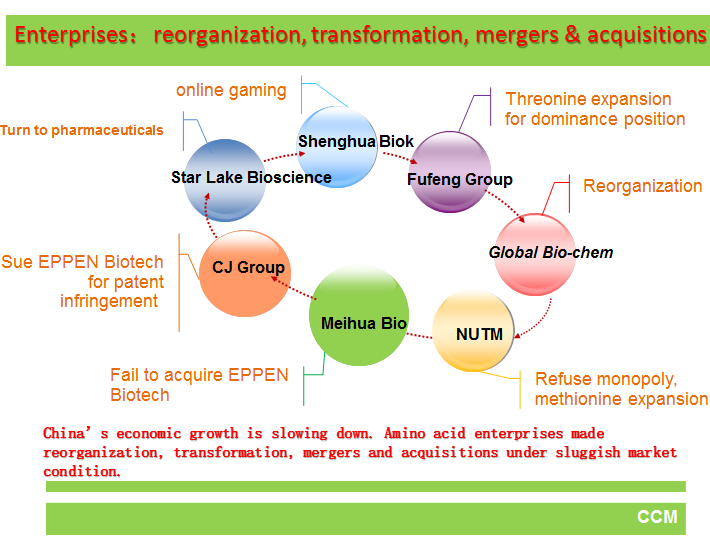

Transformation

Production

overcapacity, low prices, increasing burden from environmental protection and

product homogenization impose serious constraints on the development of amino

acid enterprises. They made sweeping transformation and reform, specifically:

-

Meihua Holdings Group Co., Ltd. (Meihua Bio) planned

to acquire Ningxia EPPEN Biotech Co., Ltd. (EPPEN Biotech)

-

Global Bio-chem Technology Group Co., Ltd. (Global

Bio-chem) made reorganization plan

Big moves

frequently occurred: reorganization, transformation, mergers and acquisitions,

listing, production expansion...

RMB

depreciation

Since Aug.

2015, RMB has been devaluing to USD. According to the People's Bank of China,

the daily exchange rate for the Chinese currency was as high as RMB6.5528 per

dollar in 28 Jan., 2016. Nevertheless, there is depreciation tendency for RMB.

Chinese produced amino acids are mainly for exports. RMB depreciation enlarges

manufacturers' profit margin to some extent.

In 2016,

Chinese farming industry is likely to recover. For amino acid industry, it will

be full of hope for enterprises. Transformation is still the mainstream of

amino acid market.

Chinese lysine market, 2015

Source:

CCM

Chinese threonine market, 2015

Source:

CCM

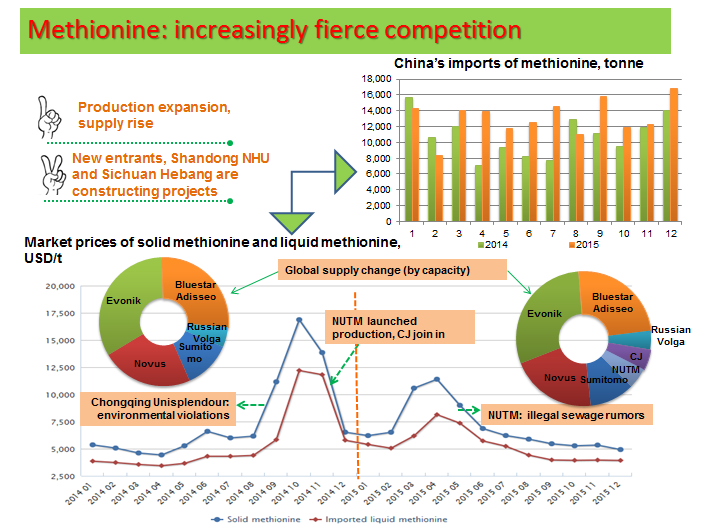

Chinese methionine market, 2015

Source:

CCM

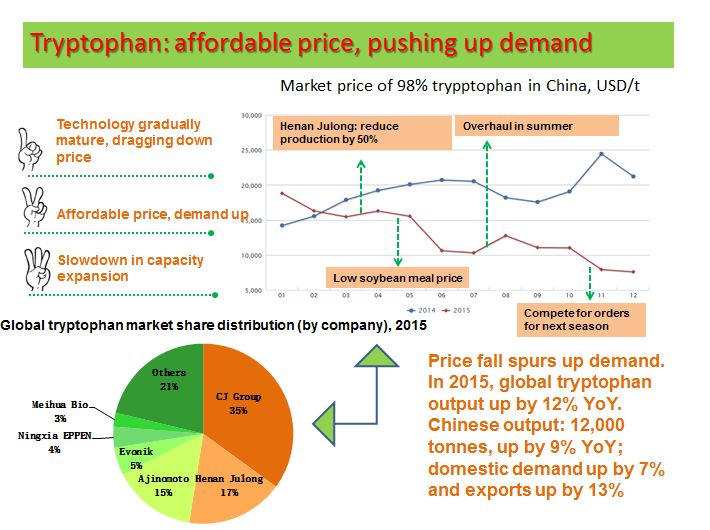

Chinese tryptophan market, 2015

Source:

CCM

China amino acid enterprises development, 2015

Source:

CCM

About CCM:

CCM

is the leading market intelligence provider for China’s agriculture,

chemicals, food & ingredients and life science markets. Founded in

2001, CCM offers a range of data and content solutions, from price and

trade data to industry newsletters and customized market research

reports. Our clients include Monsanto, DuPont, Shell, Bayer, and

Syngenta. CCM is a brand of Kcomber Inc.

For more information about CCM, please visit www.cnchemicals.com or get in touch with us directly by emailingecontact@cnchemicals.com or calling +86-20-37616606.

Tag: amino acid